How Much To Save For An Apartment Without Feeling Broke

Saving up for your first apartment can feel overwhelming—especially when you’re trying to balance bills, groceries, and still have a little fun. The question isn’t just how much to save for an apartment, but how to do it without draining your entire paycheck.

Start With A Realistic Savings Goal

Before you figure out how much to save for an apartment, research typical rent prices in your city and factor in deposits, utilities, and moving costs. Knowing your total target makes saving feel achievable instead of endless. A clear goal keeps you motivated and focused on your end result.

Create A Dedicated Apartment Fund

Open a separate savings account just for your apartment goal. It’s easier to track how much to save for an apartment when your money isn’t mixed with daily spending. Automating transfers each payday helps you stay consistent without overthinking it.

Related: How To Stage Your House To Sell Quickly

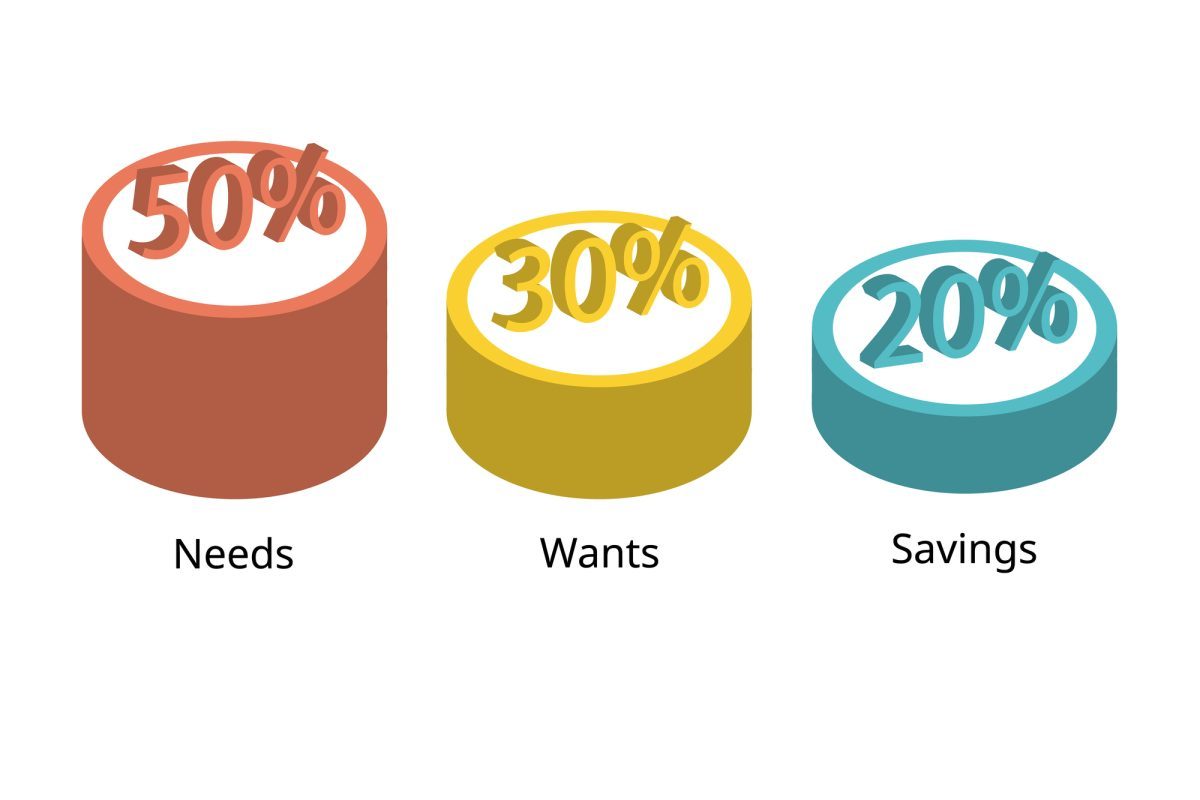

Use The 50/30/20 Budget Rule

This simple budgeting strategy is a lifesaver. Allocate 50% of income to needs, 30% to wants, and 20% to savings. When planning how much to save for an apartment, your 20% can build up quickly—especially if you trim a few unnecessary expenses.

Related: How To Stage Your House To Sell Quickly

Research Average Deposits And Fees

Every city has different rental costs, so find out how much to save for an apartment in your specific area. Include first and last month’s rent, security deposit, and application fees. Knowing these figures prevents surprise stress when it’s time to sign.

Related: How to Start a Tshirt Business at Home

Cut Down On Subscription Overload

Streaming, gym memberships, and unused apps add up fast. Canceling or pausing a few can boost your savings instantly. When you think about how much to save for an apartment, small sacrifices now create huge relief later.

Tired of money feeling messy? Get clear, simple tips for managing your family’s finances—straight to your inbox. Sign Up Here

Pick A Realistic Timeline

Instead of rushing, choose a savings timeline that fits your lifestyle. If you know how much to save for an apartment, divide that total by the number of months until your move. You’ll feel more in control and less pressured financially.

Related: Why Most People Will Never Be Rich

Track Every Expense

Understanding where your money goes is essential to knowing how much to save for an apartment efficiently. Use apps or simple spreadsheets to log spending. Seeing the numbers helps you cut back on wasteful habits and save faster.

Automate Your Savings

Set your bank to move a portion of your paycheck directly into your apartment fund. Automation removes temptation and makes how much to save for an apartment feel effortless. You’ll build consistency without constantly second-guessing yourself.

Related: Why Use A Realtor For Buying Or Selling A Home

Cut Eating Out In Half

Dining out is convenient but sneaky expensive. If you cut it by half and cook more at home, you’ll be shocked at how fast your savings grow. It’s one of the easiest ways to boost how much to save for an apartment without cutting all joy from life.

Related: 13 Habits That Keep You Broke No Matter How Much You Earn

Sell What You Don’t Need

Declutter and make cash at the same time. Old electronics, clothes, and furniture can quickly add to your apartment fund. When determining how much to save for an apartment, every extra dollar helps reduce the burden.

Want budgeting tips that actually work with a toddler on your hip? This is for you. 👉 Get The Emails

Negotiate Your Current Bills

Call your service providers and ask for better rates. Many people forget they can negotiate internet or insurance costs. Lowering bills gives you more breathing room and helps you reach how much to save for an apartment faster.

Related: Why Health Insurance Is Important For Everyone

Take Advantage Of Side Gigs

Freelancing, tutoring, or ridesharing can help you meet your savings goal faster. When figuring out how much to save for an apartment, side hustles can add hundreds each month. That extra income can cover your deposit or first month’s rent with ease.

Related: 14 Mind Tricks That Help You Stop Spending Without Feeling Poor

Avoid Impulse Purchases

Before buying something unplanned, give yourself a 24-hour rule. You’ll quickly realize most impulse buys aren’t worth it. This mindful habit keeps more cash in your account and makes how much to save for an apartment much more manageable.

Hey mama—feeling financially stuck? Join Wallet Clarity for real-life money tips made for your season. Join Here

Budget For Furniture And Moving Costs

Don’t forget the extras—beds, couches, and moving trucks can add up. When planning how much to save for an apartment, include at least a few hundred for setup expenses. That way, you move in comfortably without extra financial stress.

Related: How To Be Financially Independent

Use Cash-Back Apps And Rewards

Cash-back programs turn everyday spending into savings. Use rewards cards or rebate apps for groceries and essentials. Over time, this strategy quietly increases how much to save for an apartment without changing your lifestyle much.

Live Below Your Means For A While

This is one of the most powerful habits for anyone wondering how much to save for an apartment. Skip some luxuries temporarily and channel that money into your fund. A few months of discipline now can mean years of comfort later.

Celebrate Small Milestones

Saving is a journey—acknowledge every progress marker. Treat yourself modestly when you hit major percentages of your goal. It keeps motivation high while you continue figuring out how much to save for an apartment that fits your dream.

Related: How To Get Out Of Debt On A Low Income

Saving for your first apartment doesn’t have to feel impossible—it just takes planning and consistency. When you know how much to save for an apartment and build good money habits, you’ll reach your goal without feeling deprived. Remember, small steps add up faster than you think.

Disclaimer: This list is solely the author’s opinion based on research and publicly available information.

How To Pay Yourself As A Business Owner The Smart Way

Running your own business is exciting—you’re your own boss, calling the shots, and watching your hard work pay off. But when it comes to actually taking money out of your business, things can get a little confusing.

Read it here: How To Pay Yourself As A Business Owner The Smart Way

How To Save 2000 In Two Months Without Struggle

Saving money can feel like a huge challenge, especially when you’ve got bills, subscriptions, and spontaneous expenses popping up everywhere.

Read it here: How To Save 2000 In Two Months Without Struggle

How To Save For College

Let’s face it — college costs are no joke. But learning how to save for college doesn’t have to feel impossible or stressful. With smart planning and the right mindset, you can build a college fund that actually works for your budget.

Read it here: How To Save For College